Many people have been talking about how higher mortgage rates are making it harder for people to buy homes these days. While it's true that rates have gone up quite a bit from the all-time lows we saw during the pandemic, there are actually other factors that affect how affordable homes are. In addition to mortgage rates, things like home prices and wages also play a big role in determining how much house you can afford. So while mortgage rates are important, they're not the only thing you need to consider when it comes to buying a home.

Mortgage rates

Although they are currently higher than they were last year, they've been staying pretty steady between 6% and 7% for almost eight months now.

Take a look at the graph above - you'll see that mortgage rates have had some ups and downs over the past eight months. But here's the thing: even a tiny shift in mortgage rates can have a big impact on your ability to buy a home. That's why it's super important to have a team of real estate professionals you can rely on for expert advice and guidance. While no one can say for sure where mortgage rates will go from here, most experts agree that they'll probably continue to stay in the 6%-7% range for the foreseeable future.

Home Prices

In the last few years, we saw a rapid increase in home prices due to the incredibly low mortgage rates that were available during the pandemic. This caused a surge in buyer demand, while the supply of homes for sale remained low, resulting in an imbalance that pushed prices upwards. However, with the current higher mortgage rates, the pace of price appreciation has slowed down.

It's worth noting that the rate of home price appreciation can vary depending on the market. While some areas may experience a slight decline, others may see prices continue to climb.

According to Selma Hepp, the Chief Economist at CoreLogic, there's no one-size-fits-all answer to this trend.

“The divergence in home price changes across the U.S. reflects a tale of two housing markets. Declines in the West are due to the tech industry slowdown and a severe lack of affordability after decades of undersupply. The consistent gains in the Southeast and South reflect strong job markets, in-migration patterns and relative affordability due to new home construction.”

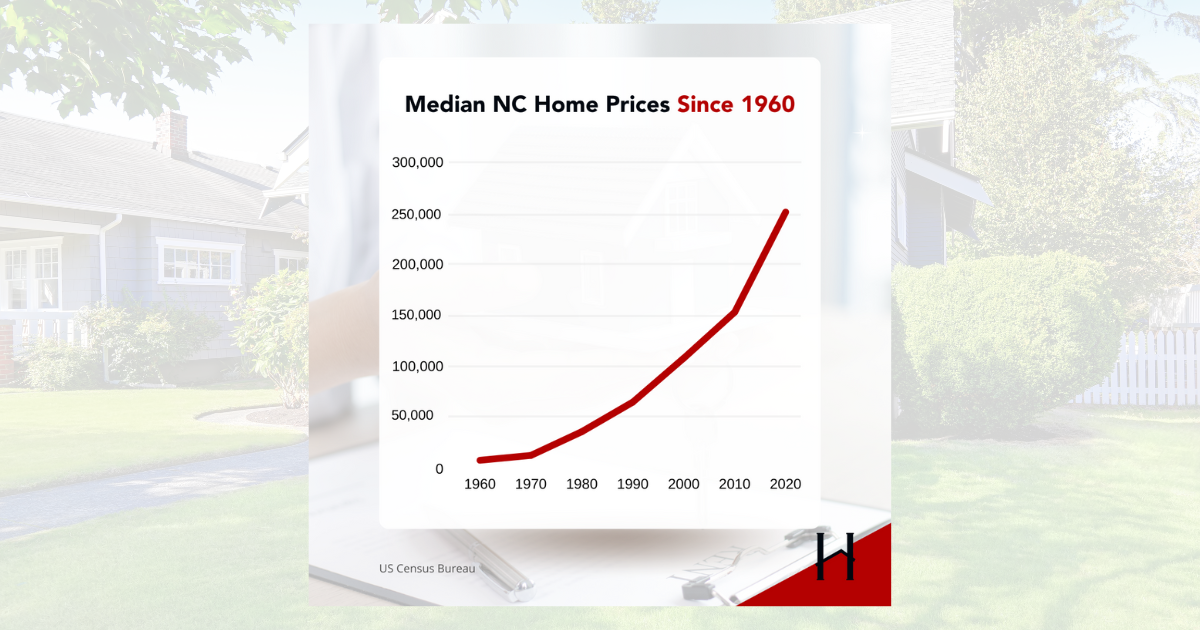

Here is how home prices in North Carolina have changed since 1960.

Wages

One of the most encouraging factors for affordability is that incomes are actually increasing. Check out this graph below that uses information from the Bureau of Labor Statistics (BLS) to illustrate how wages have grown over time.

Did you know that higher wages can actually help improve your ability to afford a home? This is because when you earn more, you don't have to put as much of your paycheck towards your monthly housing costs, which can make a big difference.

Remember, home affordability is influenced by a combination of many factors, including interest rates, home prices, wages, and others.

At Hudson Advantage Realty, we believe that an informed homebuyer is a happy homebuyer. That's why we're committed to providing you with the latest updates on interest rates, home prices, and wages so that you can make the best decision when it comes to buying a home.

Our team of experienced real estate professionals is always here to help you navigate the home-buying process. We'd love to connect with you and answer any questions you may have. So don't hesitate to reach out to us today to learn more about how we can assist you in finding your dream home. With our help, you can achieve your homeownership goals and enjoy the many benefits of owning a home.