Over the past year, home prices have been a widely debated topic. Some have said we’ll see a massive drop in prices and that this could be a repeat of 2008 . Others have forecast a real estate market that could see slight appreciation or depreciation depending on the area of the country. Remember though all real estate is LOCAL. Experts are continuing to forecast what they believe will happen with home prices this year and beyond.

Selma Hepp, Chief Economist at CoreLogic, says

“While 2023 kicked off on a more optimistic note for the U.S. housing market, recent mortgage rate volatility highlights how much uncertainty remains. Nevertheless, the continued shortage of for-sale homes is likely to keep price declines modest, which are projected to top out at 3% peak to trough.”

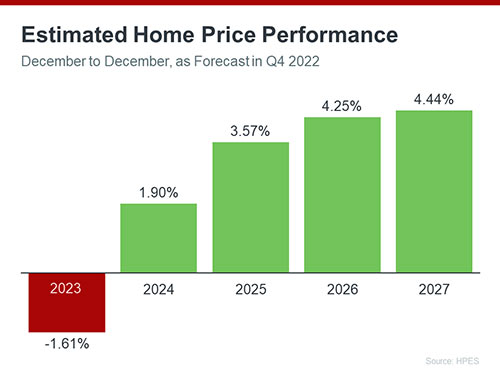

Additionally, every quarter, Pulsenomics surveys a panel of over 100 economists, investment strategists, and housing market analysts regarding their five-year expectations for future home prices in the United States. Here’s what they said most recently:

As you can see, experts are projecting slight price depreciation in the housing market this year, followed by steady appreciation. Have you heard the maxim, "Buy Low and Sell High."

Given this information and what experts are saying about home prices, you might be asking: should I buy a home this spring? It certainly looks like this is the time to "buy low." Here are three more reasons you may consider making a move:

- Buying a home helps you escape the cycle of rising rents. Over the past several decades, the median price of rent has risen consistently. The bottom line is, rents are going up. When you buy a home with a fixed-rate mortgage, you lock in your housing payment for up to 30 years! It won’t go up like it would if you rent.

- Homeownership is a hedge against inflation. A key advantage of homeownership is that it’s one of the best hedges against inflation. Your home value can rise with inflation building your net worth.

- Homeownership is a powerful wealth-building tool. The average net worth of a homeowner is $255,000 compared to $6,300 for a renter.

The decision to purchase a home is best made when you have all the facts. Hudson Advantage Realty is on your side. We will assist you every step of the way. If you're looking to buy a home this spring give us a call at 704-659-5056.